Canadian organizations face complex regulatory environments with compliance costs reaching $51.5 billion annually across all businesses in 2024, according to the Canadian Federation of Independent Business Red Tape Report. This represents a 13.5% increase from 2020 levels, with approximately $18 billion attributed to excessive red tape that could be reduced without compromising public interest. This complex multi-jurisdictional regulatory environment requires sophisticated governance, risk, and compliance (GRC) strategies that can adapt to rapidly evolving requirements across federal agencies like OSFI and provincial bodies such as Quebec’s privacy commissioners.

The regulatory landscape continues to evolve at an unprecedented pace. New privacy laws like the Consumer Privacy Protection Act (CPPA), enhanced cybersecurity requirements, and emerging AI governance frameworks create additional complexity layers. Organizations must balance Canadian federal requirements with provincial variations while meeting international standards like ISO 27001 and GDPR for global operations, making traditional compliance approaches insufficient.

This comprehensive guide provides practical frameworks for Canadian GRC compliance through step-by-step implementation strategies, regulatory mapping methodologies, and technology solutions. Whether you’re a compliance officer navigating PIPEDA requirements, a risk manager implementing OSFI guidelines, or a business leader preparing for upcoming CPPA obligations, this guide offers actionable insights for building robust GRC programs that transform regulatory complexity into strategic advantage.

If you are considering automating your organization’s GRC compliance, you may find our post on it insightful.

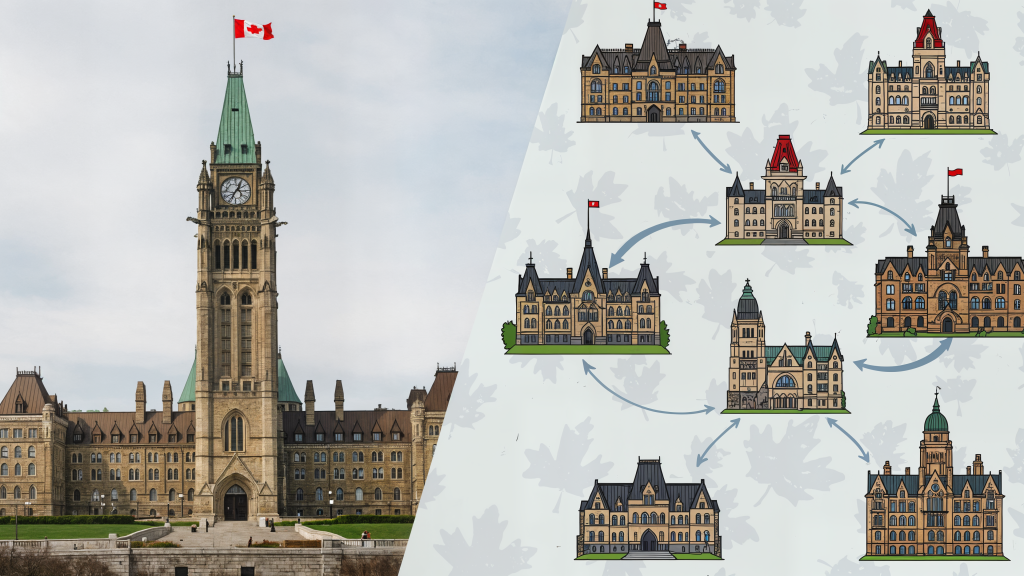

Understanding Canada’s GRC Regulatory Landscape: Federal vs Provincial Frameworks

Canada’s regulatory environment operates on multiple jurisdictional levels. Federal agencies set national standards, while provincial bodies establish regional requirements. This creates a complex web of overlapping authorities and compliance obligations.

Federal Regulatory Structure

The federal government maintains primary authority over several key areas. The Office of the Superintendent of Financial Institutions (OSFI) regulates banks, insurance companies, and pension plans. The Canadian Securities Administrators (CSA) oversee capital markets and investment firms. The Competition Bureau enforces antitrust and consumer protection laws.

Privacy regulation falls under the Personal Information Protection and Electronic Documents Act (PIPEDA).This federal law applies to private sector organizations conducting business across provincial boundaries. The Privacy Commissioner of Canada serves as the primary enforcement authority.

The Canada Revenue Agency (CRA) maintains extensive governance requirements for tax compliance. These include record-keeping obligations, reporting standards, and internal control requirements. Many organizations underestimate the GRC implications of tax compliance.

Provincial Regulatory Variations

Each province maintains distinct regulatory frameworks. Quebec operates under civil law principles, creating unique compliance requirements. The province’s Charter of the French Language adds linguistic compliance obligations for many organizations.

Alberta and British Columbia have implemented their own Personal Information Protection Acts (PIPA).These provincial laws often provide stronger privacy protections than federal PIPEDA requirements. Organizations must navigate both federal and provincial privacy obligations simultaneously.

Ontario maintains sector-specific regulations. The Personal Health Information Protection Act (PHIPA)applies to healthcare organizations. The Freedom of Information and Protection of Privacy Act (FIPPA)governs public sector entities. These laws create additional compliance layers.

Multi-Jurisdictional Complexity

Organizations operating across multiple provinces face significant challenges. A single business transaction may trigger federal, provincial, and municipal regulatory requirements. Contract terms must address varying provincial consumer protection laws.

Data residency requirements vary by jurisdiction. Some provinces require specific data to remain within geographical boundaries. Others mandate notification procedures for data breaches. These requirements directly impact technology infrastructure decisions.

Cross-border operations add another complexity layer. Organizations with US operations must consider state-specific requirements alongside Canadian obligations. European operations trigger GDPR compliance requirements that interact with Canadian privacy laws.

Essential Federal GRC Frameworks Every Canadian Organization Must Know

Federal regulations form the foundation of Canadian GRC compliance. Understanding these requirements is essential for organizations operating across provincial boundaries or in federally regulated industries.

Personal Information Protection and Electronic Documents Act (PIPEDA)

PIPEDA establishes privacy rights for personal information collected, used, or disclosed by private sector organizations. The law applies to organizations engaged in commercial activities across provincial boundaries.

The Act requires organizations to obtain meaningful consent for information collection. Consent must be specific, informed, and freely given. Organizations cannot make consent a condition of service unless the information is necessary for the transaction.

PIPEDA mandates privacy policies that explain information handling practices. These policies must be written in clear, understandable language. Organizations must make policies readily available to individuals upon request.

The law includes specific breach notification requirements. Organizations must notify the Privacy Commissioner of Canada about breaches involving real risk of significant harm. Affected individuals must also receive notification under specific circumstances.

Organizations must designate privacy officers responsible for PIPEDA compliance. These officers serve as primary contacts for privacy-related inquiries and complaints. They must have sufficient authority and resources to fulfill their responsibilities effectively.

For a comprehensive implementation guide, see our PIPEDA Compliance Checklist.

Office of the Superintendent of Financial Institutions (OSFI) Guidelines

OSFI oversees federally regulated financial institutions including banks, insurance companies, and pension plans. The organization’s guidelines establish comprehensive governance and risk management expectations.

Guideline B-10 addresses third-party risk management. Financial institutions must implement robust vendor management programs. These programs must include due diligence procedures, ongoing monitoring requirements, and contingency planning.

The Corporate Governance Guideline establishes board responsibilities and accountability frameworks. Boards must maintain appropriate expertise and independence. They must oversee risk management functions and ensure adequate internal controls.

OSFI’s Operational Risk Management Guideline requires institutions to identify, assess, and manage operational risks. This includes cybersecurity risks, business continuity risks, and compliance risks. Institutions must maintain comprehensive risk registers and mitigation strategies.

Capital adequacy requirements under Basel III create additional governance obligations. Institutions must maintain robust capital planning processes and stress testing capabilities. These requirements directly impact strategic planning and resource allocation decisions.

Competition Act Compliance

The Competition Act prohibits anti-competitive business practices. The Act applies to all organizations operating in Canada, regardless of size or industry. Violations can result in significant penalties and criminal charges.

The Act prohibits price-fixing agreements between competitors. Organizations must implement policies preventing coordination on pricing, market allocation, or bid rigging. Training programs must educate employees about prohibited activities.

Merger and acquisition activities require Competition Bureau notification under specific circumstances. Organizations must assess transaction thresholds and notification requirements early in the process. Failure to notify can result in significant penalties.

The Act includes provisions addressing abuse of dominant market position. Organizations with significantmarket power face heightened scrutiny. Pricing strategies, exclusive dealing arrangements, and refusal todeal practices require careful legal analysis.

Compliance programs must include regular legal risk assessments. Organizations should conduct periodic reviews of pricing policies, partnership agreements, and market practices. Documentation and training play critical roles in demonstrating compliance intent.

Provincial GRC Requirements: Navigating Canada’s Regional Compliance Maze

Provincial regulations create additional compliance layers that vary significantly across Canada. Organizations must understand these variations to develop effective GRC strategies.

Quebec’s Unique Regulatory Environment

Quebec operates under civil law principles derived from the French legal tradition. This creates fundamental differences in contract interpretation, liability concepts, and regulatory enforcement approaches.

Bill 64, also known as Law 25, an Act to modernize legislative provisions as regards the protection of personal information, substantially updates Quebec’s privacy framework. The law introduces new consent requirements, data portability rights, and breach notification obligations.

The Charter of the French Language requires organizations to conduct business in French. This impacts contract terms, employee communications, and customer service delivery. Compliance requires ongoing linguistic monitoring and staff training.

Quebec’s consumer protection laws provide stronger protections than many other provinces. The Consumer Protection Act includes specific provisions for distance contracts, extended warranties, and dispute resolution procedures. These requirements directly impact business operations and customer relationships.

Professional licensing requirements in Quebec often differ from other provinces. Organizations must verify licensing requirements for employees providing professional services. Mutual recognition agreements may not cover all professional activities.

Alberta and British Columbia PIPA Requirements

Alberta’s Personal Information Protection Act (PIPA) and British Columbia’s equivalent create privacy obligations that often exceed federal PIPEDA requirements. Organizations must comply with both federal and provincial privacy laws simultaneously.

PIPA requires organizations to limit information collection to reasonable purposes. The definition of “reasonable” often differs from federal interpretations. Organizations must conduct purpose limitation assessments for all information collection activities.

The provincial Acts include stronger consent requirements than PIPEDA. Organizations must obtain express consent for sensitive personal information. Implied consent provisions are more restrictive than federal requirements.

Breach notification requirements under provincial PIPA laws differ from federal obligations. Organizations must notify provincial privacy commissioners about breaches meeting specific criteria. Notification timelines and content requirements vary between provinces.

Organizations must designate privacy officers under provincial PIPA requirements. These officers must have specific qualifications and authority levels. They serve as primary contacts for provincial privacy investigations and complaints.

Ontario’s Sectoral Regulation Approach

Ontario maintains sector-specific privacy and governance requirements. The Personal Health Information Protection Act (PHIPA) applies to healthcare organizations. The Municipal Freedom of Information and Protection of Privacy Act (MFIPPA) governs municipal organizations.

PHIPA creates specific obligations for health information custodians. These include access and correction rights, use and disclosure limitations, and security safeguard requirements. Compliance requires detailed policies and staff training programs.

The Accessibility for Ontarians with Disabilities Act (AODA) creates governance obligations for organizations with Ontario operations. Compliance requires accessibility policies, training programs, and barrier removal initiatives.

Ontario’s securities regulations include specific governance requirements for public companies. The Ontario Securities Commission (OSC) maintains disclosure obligations, insider trading restrictions, and director qualification requirements.

Organizations must navigate multiple regulatory relationships simultaneously. A single business activity may trigger requirements under several provincial Acts. Compliance requires careful coordination and comprehensive policy development.

International Standards Integration: ISO 27001, NIST, and Global Framework Alignment

Canadian organizations increasingly adopt international standards to meet customer requirements, support global operations, and demonstrate security maturity. These standards must be integrated with Canadian regulatory requirements.

ISO 27001 Information Security Management Systems

ISO 27001 provides a systematic approach to managing sensitive information. The standard requires organizations to establish, implement, maintain, and continually improve information security management systems (ISMS).

The standard’s risk-based approach aligns well with Canadian regulatory expectations. Organizations must conduct comprehensive risk assessments considering confidentiality, integrity, and availability impacts. Risk treatment plans must address identified vulnerabilities systematically.

ISO 27001 certification requires annual surveillance audits and triennial certification renewals. Canadian certification bodies must demonstrate competence through accreditation programs. Organizations should verify certification body credentials before beginning the certification process.

The standard includes 114 security controls across 14 categories. Organizations must implement controls appropriate for their risk profile and business context. Canadian organizations often integrate PIPEDA privacy requirements into their control implementation strategies.

Document management requirements under ISO 27001 support Canadian regulatory compliance. The standard requires organizations to maintain comprehensive policies, procedures, and records. These documents often satisfy multiple regulatory requirements simultaneously.

ISO 42001 Artificial Intelligence Management Systems

ISO 42001 addresses the growing importance of AI governance. The standard provides systematic approaches for managing AI risks and opportunities. Early adoption positions organizations advantageously as AI regulations evolve.

The standard requires organizations to establish AI governance structures. These structures must include executive oversight, risk management processes, and stakeholder engagement mechanisms. Canadian organizations must consider federal AI strategy implications.

Risk assessment requirements under ISO 42001 address algorithmic bias, privacy impacts, and safety considerations. Organizations must implement continuous monitoring and improvement processes. These requirements align with emerging Canadian AI regulatory expectations.

The standard emphasizes transparency and explainability in AI systems. Organizations must document AI decision-making processes and maintain audit trails. These requirements support Canadian privacy law compliance and consumer protection obligations.

Implementation strategies must consider sector-specific AI risks. Healthcare organizations face different AI challenges than financial services firms. Canadian organizations should tailor their approaches to industry-specific regulatory expectations.

NIST Cybersecurity Framework Integration

The NIST Cybersecurity Framework provides structured approaches to cybersecurity risk management. Many Canadian organizations adopt NIST frameworks to demonstrate security maturity and support regulatory compliance.

The Framework’s five core functions – Identify, Protect, Detect, Respond, and Recover – provide comprehensive cybersecurity program structure. Organizations can map Canadian regulatory requirements to Framework subcategories.

NIST Framework profiles help organizations assess current cybersecurity posture and identify improvement opportunities. Canadian organizations should consider federal cybersecurity strategies and provincial requirements when developing profiles.

The Framework emphasizes risk-based approaches to cybersecurity decision-making. Organizations must consider business context, regulatory requirements, and threat landscapes when implementing controls. This approach aligns with Canadian regulatory expectations.

Framework implementation supports multiple compliance objectives simultaneously. Organizations can demonstrate regulatory compliance while building robust cybersecurity capabilities. This efficiency makes NIST Framework adoption attractive for resource-constrained organizations.

CIS Security Controls Implementation

The CIS Controls provide specific, actionable cybersecurity recommendations. The controls are organized into Implementation Groups based on organizational size and cybersecurity maturity levels.

Implementation Group 1 controls address fundamental cybersecurity hygiene. These controls include asset inventory, software inventory, and security configuration management. Most Canadian organizations should implement these controls regardless of regulatory requirements.

Implementation Group 2 controls address enterprise-level cybersecurity needs. These controls include network monitoring, malware protection, and incident response capabilities. Organizations with significant cybersecurity risks should implement these controls.

Implementation Group 3 controls address advanced threat protection. These controls include security awareness training, penetration testing, and threat intelligence capabilities. Organizations in critical infrastructure sectors should consider these advanced controls.

CIS Controls mapping to Canadian regulatory requirements helps organizations demonstrate compliance efficiently. Many controls address multiple regulatory obligations simultaneously. This efficiency supports cost-effective compliance program development.

GDPR Compliance for Canadian Organizations

GDPR applies to Canadian organizations processing EU residents’ personal data. The regulation’s extraterritorial scope affects Canadian companies with European customers, suppliers, or operations regardless of physical presence in the EU.

Organizations must distinguish between data controller and processor roles under GDPR. Controllers determine processing purposes and means, while processors handle data on behalf of controllers. Canadian organizations typically act as controllers for customer data while serving as processors for client services.

GDPR establishes six lawful bases for processing: consent, contract, legal obligation, vital interests, public task, and legitimate interests. Organizations must identify and document appropriate lawful bases for each processing activity. Consent requirements exceed Canadian privacy law standards, requiring explicit, informed, and freely given agreement

Data subject rights create operational obligations for Canadian organizations. Individuals can access, rectify, erase, restrict, port, and object to processing of their personal data. Organizations must implement processes for handling rights requests within GDPR’s strict timelines.

Privacy by design and default principles require integrating data protection into system design and business processes. Technical and organizational measures must ensure only necessary data processing occurs with appropriate security controls implemented.

Cross-border data transfers require appropriate safeguards. Canada’s partial adequacy decision covers only PIPEDA-subject commercial organizations. Standard contractual clauses provide the primary transfer mechanism, often requiring supplementary measures to ensure adequate protection levels.

Industry-Specific GRC Frameworks: Sector-Tailored Compliance Strategies

Different industries face unique regulatory requirements and risk profiles. Organizations must tailor their GRC approaches to address industry-specific challenges while maintaining comprehensive compliance programs.

Financial Services Regulatory Requirements

Canadian financial institutions operate under comprehensive regulatory frameworks. OSFI guidelines establish governance, risk management, and internal control expectations. Provincial securities regulators add additional layers of requirements.

SOX compliance requirements apply to publicly traded financial institutions. Section 404 internal control requirements create significant documentation and testing obligations. Organizations must maintain detailed control narratives and test procedures.

PCI DSS requirements apply to organizations processing payment card information. The standard includes specific technical and operational requirements for cardholder data protection. Compliance requires annual assessments and ongoing monitoring.

Anti-money laundering (AML) and anti-terrorist financing (ATF) requirements create additional compliance obligations. Organizations must implement customer due diligence procedures, transaction monitoring systems, and suspicious activity reporting processes.

Basel III capital adequacy requirements impact strategic planning and resource allocation decisions. Organizations must maintain robust capital planning processes and stress testing capabilities. These requirements influence business strategy and risk appetite decisions.

Healthcare Sector Compliance

Healthcare organizations face complex privacy and security requirements. Provincial health information protection Acts create specific obligations for health information custodians. Federal regulations address medical device safety and pharmaceutical compliance.

PHIPA requirements in Ontario create specific obligations for healthcare providers. Organizations must implement administrative, technical, and physical safeguards for health information protection. Compliance requires comprehensive policies and staff training programs.

HIPAA compliance requirements apply to Canadian healthcare organizations processing information for US patients or providers. Organizations must implement business associate agreements and maintain compliance documentation.

Medical device regulations under Health Canada create specific quality management requirements.Organizations must implement ISO 13485 quality management systems and maintain comprehensivedocumentation. Compliance requires ongoing monitoring and improvement processes.

Pharmaceutical regulations create additional compliance obligations. Good Manufacturing Practices(GMP) requirements address quality control, documentation, and facility management. Organizations must maintain detailed batch records and quality control documentation.

Energy Sector Regulatory Framework

Energy sector organizations face federal and provincial regulatory requirements. The National Energy Board regulates interprovincial and international energy infrastructure. Provincial energy regulators oversee local distribution and generation facilities.

NERC CIP requirements apply to organizations operating critical infrastructure. The standards address cybersecurity controls for bulk electric system reliability. Compliance requires comprehensive cybersecurity programs and ongoing monitoring.

Environmental compliance requirements impact energy sector operations significantly. Organizations must implement environmental management systems and maintain comprehensive monitoring programs. Compliance requires ongoing stakeholder engagement and regulatory reporting.

Pipeline safety regulations create specific operational and maintenance requirements. Organizations must implement integrity management programs and maintain detailed inspection records. Compliance requires specialized technical expertise and ongoing investment.

Indigenous consultation requirements impact energy project development. Organizations must implement meaningful consultation processes and maintain ongoing relationships with affected

communities. Compliance requires cultural sensitivity and long-term commitment.

Technology Sector Considerations

Technology sector organizations face rapidly evolving regulatory requirements. Privacy laws, cybersecurity regulations, and emerging AI governance frameworks create complex compliance challenges.

SOC 2 compliance requirements apply to organizations providing cloud services. Type II reports require ongoing monitoring and reporting of security controls. Compliance requires comprehensive documentation and independent auditing.

GDPR compliance requirements apply to Canadian technology organizations processing EU personal data. Organizations must implement data protection by design and default principles. Compliance requires comprehensive privacy impact assessments and ongoing monitoring.

Export control regulations impact technology organizations with international operations. Organizations must implement export control compliance programs and maintain detailed documentation. Compliance requires ongoing monitoring of regulatory changes and technology developments.

Emerging AI governance requirements create new compliance challenges. Organizations must implement AI ethics frameworks and maintain algorithmic transparency. Compliance requires ongoing stakeholder engagement and regulatory monitoring.

Building Your Canadian GRC Implementation Framework: Step-by-Step Methodology

Effective GRC implementation requires systematic approaches that address Canadian regulatory requirements while supporting business objectives. This methodology provides structured guidance for organizations at any maturity level.

Phase 1: Regulatory Inventory and Mapping

Begin with comprehensive regulatory inventory across all business activities. Identify federal, provincial, and municipal requirements applicable to your organization. Include industry-specific regulations and international standards requirements.

Create detailed regulatory mapping documents linking requirements to business processes. Identify overlapping requirements and potential conflicts between jurisdictions. Document exemptions, safe harbors, and regulatory relief provisions.

Develop regulatory change monitoring processes to track updates and amendments. Subscribe to regulatory agency notifications and industry association alerts. Assign responsibility for monitoring specific regulatory areas to qualified personnel.

Establish regulatory interpretation procedures for complex or ambiguous requirements. Develop relationships with external legal counsel and regulatory experts. Document interpretation decisions and rationale for future reference.

Phase 2: Risk Assessment and Prioritization

Conduct comprehensive risk assessments considering regulatory compliance risks alongside operational and strategic risks. Use structured methodologies like NIST RMF or ISO 27005 to ensure consistency and completeness.

Assess likelihood and impact of regulatory violations for each identified requirement. Consider financial penalties, operational disruptions, and reputational damage in impact calculations. Document assumptions and methodologies for future updates.

Prioritize risks based on regulatory criticality and business impact. Focus initial implementation efforts onhigh-risk areas with significant regulatory exposure. Develop risk treatment strategies appropriate foreach risk level.

Integrate regulatory risk assessments into enterprise risk management processes. Ensure regulatory risks receive appropriate board and executive attention. Establish reporting mechanisms for regulatory risk status updates.

Phase 3: Policy and Procedure Development

Develop comprehensive policy frameworks addressing all identified regulatory requirements. Ensure policies reflect current regulatory interpretations and business practices. Include clear roles, responsibilities, and accountability mechanisms.

Create detailed procedures supporting policy implementation. Include step-by-step instructions, decision trees, and escalation procedures. Ensure procedures address both routine operations and exception handling.

Integrate international standards requirements into policy development. Map ISO 27001, SOC 2, and NIST framework requirements to regulatory obligations. Develop unified policies addressing multiple compliance objectives.

Establish policy governance processes including review cycles, approval authorities, and changemanagement procedures. Ensure policies remain current with regulatory changes and business evolution.

Phase 4: Implementation and Monitoring

Implement policies and procedures systematically across all business units. Provide comprehensive training to ensure staff understand their compliance obligations. Establish monitoring mechanisms to

verify ongoing compliance.

Deploy technology solutions supporting compliance monitoring and reporting. Implement automated controls where possible to reduce human error and improve efficiency. Ensure technology solutions address data residency and sovereignty requirements.

Establish key performance indicators (KPIs) for compliance program effectiveness. Monitor compliance metrics regularly and report to executive leadership. Develop corrective action procedures for compliance deficiencies.

Create comprehensive documentation supporting compliance activities. Maintain audit trails for all compliance-related decisions and actions. Ensure documentation meets regulatory requirements and supports audit activities.

Phase 5: Continuous Improvement

Establish regular compliance program reviews to identify improvement opportunities. Conduct lessons learned sessions following compliance incidents or regulatory examinations. Update policies and procedures based on review findings.

Benchmark compliance program effectiveness against industry peers and best practices. Participate in industry associations and regulatory working groups. Share experiences and learn from other organizations’ approaches.

Integrate compliance program performance into business performance metrics. Ensure compliance contributes to business objectives rather than creating obstacles. Develop business cases for compliance program investments.

Maintain current awareness of regulatory trends and emerging requirements. Anticipate future compliance challenges and begin preparation early. Position compliance program as strategic enabler rather than operational burden.

Technology Solutions for Canadian GRC Compliance: Tools and Platforms

Technology plays a critical role in effective GRC compliance. Organizations must select solutions that address Canadian regulatory requirements while supporting international standards and business objectives.

Data Residency and Sovereignty Considerations

Canadian data residency requirements impact technology architecture decisions significantly. Organizations must understand federal and provincial data location requirements. Some regulations require specific data types to remain within Canada.

GDPR adequacy decisions affect Canadian organizations with European operations. Organizations must implement appropriate safeguards for international data transfers. Technology solutions must support data localization and transfer restriction requirements.

Cloud service provider selection requires careful evaluation of data residency capabilities. Verify providers maintain appropriate certifications and compliance attestations. Ensure service agreements include adequate data protection and location provisions.

ISO 27001 hosting considerations impact technology solution selection. Organizations seeking certification must ensure hosting providers meet security control requirements. Shared responsibility models must clearly define security obligations.

GRC Platform Capabilities

Comprehensive GRC platforms provide integrated solutions for regulatory compliance, risk management, and governance activities. Platforms should support multiple regulatory frameworks simultaneously.

Automated compliance monitoring capabilities reduce manual effort and improve accuracy. Platforms should include regulatory content libraries covering Canadian federal and provincial requirements. Regular updates ensure content remains current.

Risk assessment and management capabilities should support multiple methodologies including NISTRMF and ISO 27005. Platforms should enable risk register maintenance, treatment tracking, and reporting automation.

Policy and procedure management capabilities should support version control, approval workflows, anddistribution tracking. Platforms should enable automated policy reviews and update notifications.

Incident management capabilities should support Canadian breach notification requirements. Platforms should enable incident tracking, investigation management, and regulatory reporting automation.

Integration with Existing Systems

GRC technology solutions must integrate with existing enterprise systems. API capabilities enable data sharing between GRC platforms and business applications. Integration reduces duplicate data entry and improves data quality.

Identity and access management integration ensures consistent user authentication and authorization. Single sign-on capabilities improve user experience while maintaining security. Role-based access controls support segregation of duties requirements.

Enterprise resource planning (ERP) integration enables automated control testing and monitoring. Financial data integration supports SOX compliance and internal control testing. Integration improves control effectiveness and reduces manual testing effort.

Security information and event management (SIEM) integration supports continuous monitoring and threat detection. Automated alert correlation improves incident response effectiveness. Integration enables comprehensive security monitoring across technology infrastructure.

Vendor Evaluation Criteria

Technology vendor evaluation should include specific Canadian compliance capabilities. Vendors should demonstrate understanding of Canadian regulatory requirements and implementation experience.

Vendor security controls should meet international standards including SOC 2 and ISO 27001. Verify vendor compliance attestations and certification status. Ensure vendors maintain appropriate cybersecurity insurance coverage.

Vendor financial stability and business continuity capabilities impact long-term technology sustainability. Evaluate vendor financial statements and business continuity plans. Ensure vendor failure scenarios include data migration and service continuation options.

Vendor support capabilities should include Canadian presence and regulatory expertise. Verify vendor ability to provide ongoing support and maintenance services. Ensure vendor staff maintain appropriate security clearances and background checks.

Emerging Regulatory Trends and Future-Proofing Your GRC Strategy

Regulatory environments evolve continuously. Organizations must anticipate future requirements and adapt their GRC strategies accordingly. Understanding emerging trends enables proactive compliance preparation.

Artificial Intelligence and Algorithmic Accountability

The Artificial Intelligence and Data Commissioner Act represents Canada’s emerging approach to AI governance. The Act will establish oversight mechanisms for AI systems impacting individuals and society.

Algorithmic accountability requirements will create new compliance obligations for organizations using AI systems. Organizations must implement transparency measures, bias testing, and impact assessments for AI applications.

AI risk management frameworks will become increasingly important. Organizations should implement AI governance structures including ethics committees, risk assessment procedures, and ongoing monitoring capabilities.

Privacy impact assessments will expand to include AI-specific considerations. Organizations must evaluate AI systems for privacy risks, algorithmic bias, and discriminatory impacts. Assessment methodologies will evolve as regulatory guidance develops.

Consumer Privacy Protection Act Transition

The Consumer Privacy Protection Act (CPPA) will replace PIPEDA as Canada’s federal privacy law. The CPPA includes strengthened individual rights, increased penalties, and expanded enforcement powers.

Data portability rights under CPPA will require organizations to provide personal information in structured formats. Organizations must implement technical capabilities supporting data export and transfer requirements.

Consent requirements under CPPA will become more stringent. Organizations must implement granular consent mechanisms and provide clear withdrawal options. Implied consent provisions will be more restrictive than current PIPEDA requirements.

Breach notification requirements will expand under CPPA. Organizations must notify individuals and regulators about breaches meeting lower thresholds than current requirements. Notification timelines will become more demanding.

Provincial Privacy Law Modernization

Provincial privacy laws continue evolving to address emerging technologies and privacy concerns. Organizations must monitor provincial legislative developments and adapt compliance programs accordingly.

Quebec’s Bill 64 implementation creates new privacy obligations including data portability rights and enhanced consent requirements. Organizations operating in Quebec must implement additional privacy controls.

Other provinces are considering privacy law updates addressing emerging technologies. Organizations should monitor provincial legislative developments and participate in consultation processes where appropriate.

Harmonization efforts between federal and provincial privacy laws may create more consistent requirements. Organizations should prepare for potential regulatory consolidation and standardization initiatives.

Environmental, Social, and Governance (ESG) Reporting

ESG reporting requirements are expanding globally and will impact Canadian organizations. Climate-related financial disclosures will become mandatory for many organizations.

Sustainability reporting standards are evolving rapidly. Organizations should monitor developments in ESG reporting frameworks and prepare for mandatory disclosure requirements.

Supply chain transparency requirements will create new compliance obligations. Organizations must implement due diligence procedures for supplier environmental and social practices.

Stakeholder engagement requirements will expand beyond traditional shareholders. Organizations must develop comprehensive stakeholder management programs addressing community, environmental, and social concerns.

Cybersecurity and Critical Infrastructure Protection

Critical infrastructure protection requirements continue expanding. Organizations operating critical infrastructure must implement enhanced cybersecurity controls and reporting mechanisms.

Cyber incident reporting requirements will become more comprehensive. Organizations must implement incident detection, assessment, and reporting capabilities meeting regulatory timelines.

Supply chain cybersecurity requirements will impact vendor management programs. Organizations must implement cybersecurity due diligence procedures for critical suppliers and service providers.

International cybersecurity cooperation requirements may impact Canadian organizations with global operations. Organizations should monitor international cybersecurity policy developments and compliance implications.

Measuring GRC Success: KPIs, Reporting, and Continuous Improvement

Effective GRC programs require systematic measurement and continuous improvement. Organizations must establish meaningful metrics that demonstrate compliance effectiveness and business value.

Key Performance Indicators for Canadian GRC

Regulatory compliance metrics should track adherence to specific requirements across federal and provincial jurisdictions. Measure compliance percentages for each major regulatory area. Track compliance improvement trends over time.

Risk management metrics should quantify risk reduction and mitigation effectiveness. Measure risk exposure levels before and after control implementation. Track risk treatment plan completion rates and effectiveness.

Incident metrics should track regulatory violations, near-misses, and improvement opportunities. Measure incident response times and resolution effectiveness. Track repeat incidents and root cause analysis completion.

Training and awareness metrics should measure program reach and effectiveness. Track training completion rates and knowledge retention. Measure awareness levels through surveys and assessments.

Cost metrics should track compliance program expenses and return on investment. Measure cost per compliance requirement and cost trends over time. Track cost avoidance through proactive compliance management.

Canadian Regulatory Reporting Requirements

Federal reporting requirements vary by regulation and industry. PIPEDA requires annual reporting to Parliament on privacy complaint trends and enforcement activities. Financial institutions must report to OSFI on various governance and risk management metrics.

Provincial reporting requirements differ across jurisdictions. Some provinces require annual privacy reports or compliance attestations. Organizations must track reporting requirements and deadlines across all applicable jurisdictions.

Industry association reporting may be required for specific sectors. Professional licensing bodies often require compliance reporting from member organizations. Industry regulators may require periodic compliance updates or assessments.

Board reporting should include compliance status, risk levels, and program effectiveness metrics. Reports should highlight significant compliance issues and improvement initiatives. Board reports should connect compliance performance to business objectives.

Audit Preparation and Regulatory Examination Readiness

Regulatory examination preparation requires comprehensive documentation and staff training. Organizations should maintain current compliance evidence and supporting documentation. Staff should understand their roles during regulatory examinations.

Internal audit programs should include regular compliance assessments. Audit findings should be trackedand resolved systematically. Internal audit reports should be shared with appropriate governance bodies.

External audit coordination ensures consistent messaging and efficient processes. Organizations should maintain relationships with qualified external auditors. Audit results should be integrated into compliance program improvements.

Examination response procedures should be documented and tested. Staff should understand information requests and response procedures. Organizations should maintain communication protocols for regulatory interactions.

Continuous Improvement Methodologies

Compliance program reviews should occur regularly and systematically. Reviews should assess program effectiveness, efficiency, and alignment with business objectives. Review findings should drive program

improvements and updates.

Benchmarking against industry peers provides valuable improvement insights. Organizations should participate in industry benchmarking studies and working groups. Benchmarking results should inform program enhancement initiatives.

Regulatory change management ensures programs remain current with evolving requirements. Changemanagement procedures should address regulatory updates, business changes, and technologyevolution. Changes should be implemented systematically with appropriate testing and validation.

Performance measurement should support data-driven decision making. Organizations should collectand analyze compliance metrics regularly. Performance data should inform resource allocation andprogram priority decisions.

Conclusion: Building Sustainable GRC Excellence in Canada

Canadian GRC compliance requires comprehensive approaches that address multi-jurisdictional requirements while supporting business objectives. Organizations must balance federal and provincial obligations with international standards and industry-specific requirements.

Successful GRC implementation begins with systematic regulatory inventory and risk assessment. Organizations must understand their specific compliance obligations and prioritize implementation efforts accordingly. Technology solutions should support efficiency while maintaining compliance effectiveness.

Emerging regulatory trends require proactive adaptation and continuous improvement. Organizations should monitor regulatory developments and adapt their programs accordingly. Early preparation for regulatory changes provides competitive advantages and reduces implementation costs.

Measurement and continuous improvement ensure GRC programs remain effective and efficient. Organizations should establish meaningful metrics and regularly assess program performance. Continuous improvement methodologies support program evolution and business value creation.

The investment in comprehensive GRC programs pays dividends through reduced regulatory risk, operational efficiency, and competitive advantage. Organizations with mature GRC capabilities are better positioned to navigate regulatory complexity and capitalize on business opportunities.

Canadian organizations that implement systematic GRC approaches will thrive in the evolving regulatorylandscape. The frameworks and strategies outlined in this guide provide practical foundations for GRCexcellence. Success requires commitment, resources, and ongoing attention to regulatory developments.

Your GRC journey begins with understanding current requirements and building systematic implementation capabilities. The complexity of Canadian regulatory requirements makes professional

guidance valuable for most organizations. Consider engaging qualified GRC professionals to accelerate your program development and ensure comprehensive compliance coverage.